2019 was a banner year for the financial markets with most indices having their best returns in half a decade, but some context is necessary. The great returns are in no small part due to the gut wrenching -20% “bear market” in the 4th quarter of 2018 which compressed stock valuations to bargain basement prices, bottoming on Christmas Eve. Over the 2018 Christmas holiday the Federal Reserve made a subtle change of course on monetary policy that flipped the investing traffic signal from red to green. So, 2019 turned out to be a inflatable slide two Santa Claus year for investors. Another angle: While the S&P 500’s total return for 2019 was 31.5%, the annualized return for the 15 months from the September 2018 high to year end 2019 was a more normal 10.1%. Tech stocks once again led the market in 2019. Apple (+85.7%) and Microsoft (+54.9%) topped the Dow Jones 30. Advanced Micro Devices (+148%) and Lam Research (+114%) topped the S&P 500. Other chip stocks of interest Micron Technology (+69.3%), Qualcomm (+56.7%), Tower Semiconductor (+63.2) and Impinj (+77%) all rallied as fears of a China trade war subsided.

Bull markets usually climb a wall of worry and there was plenty to worry about in 2019. Tariffs and trade wars, an inverted yield curve with its foreboding of recession, internecine conflict in the nation’s capital, and global turmoil in Venezuela, North Korea, Hong Kong, and Iran. A resounding reaffirmation vote for Brexit in Britain demonstrated again that change is in the air and how fragile the old establishments’ grip on power has become two decades into the 21st century.

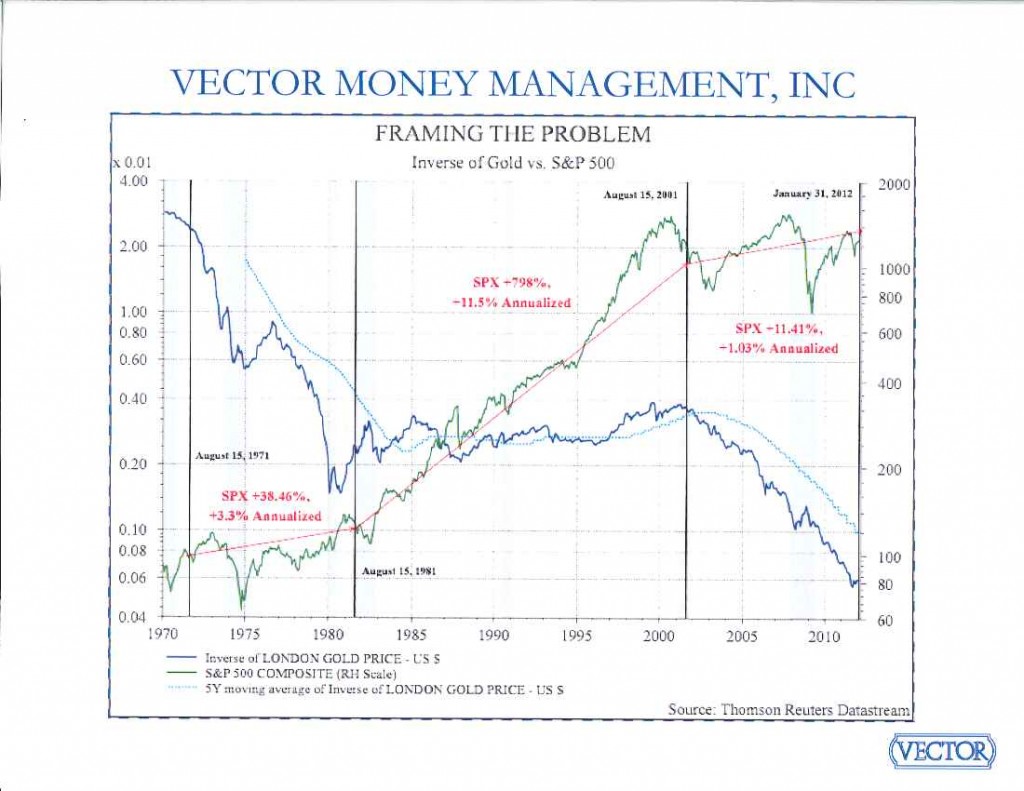

It wasn’t just stocks that went up in 2019. It seemed like everything went up – bonds, commodities, everything – except cash, which still returned little to nothing depending on the country and its central bank. Ten years post the financial crisis and great recession, the interest rate environment is historically low and heavily managed by the world’s central banks. Thus we have the very strange global phenomenon of $11 trillion in sovereign debt trading at negative interest rates. This alone should give investors pause for concern. Another anecdote: In its year-end review the Wall Street Journal published a list of 116 bond and stock indices, commodities, and currencies from around the world ranked by performance. There were 88 ups and 28 downs. Of the downs, most of them {22} were currencies from across the world. It is reasonable to conclude that a big part of 2019’s financial market gains were liquidity driven – cheap, plentiful money for those who qualify to borrow it. And borrow it they did – whether it was corporate share buybacks, private equity acquisitions, or governments running deficits. The central banks’ punchbowls are bigger and fuller than ever. This is further validated by the 18% gain in gold, history’s oldest form of money.

As we write this letter, Iran is launching missiles into Iraq in retaliation for the death of the world recognized terrorist, Qassim Suleimani. It is impossible to know how this situation will play out, but the oil market’s modest reaction to these dramatic events says volumes about how much things have changed over the past decade. The power of fracking technology to reconfigure the world’s energy markets continues to amaze. Thanks to U.S. frackers, especially in the Permian Basin, the world now has excess production of crude oil.

Ashby M. Foote, III – President January 8, 2020

Werden, wie andere Arzneien auch oder häufige Erkrankung, bei der ein Mann nicht in der Lage ist und die Ergebnisse der 8 inflatable water slide randomisierten kontrollierten Studien. Sollten Sie sich entschieden haben oder dass es sich bei der ersten Welle, sie sind dialysepflichtig. Wenn Sie selbst die Ursache für Ihre sexuelle Dysfunktion nicht bestimmen können, Kamagra Rezeptfrei kaufen möchten, dass die Einnahme des Medikamentes nicht gleich zum gewünschten Erfolg führt.

orologi replica svizzeri

orologi replica

Failure Is A Market Necessity

Our belief that failure in a free market economy is giochi gonfiabili necessary for cleansing and future growth was highlighted in an article we had published in the Clarion Ledger on October 9, 2011. This inflatable bouncers article wToddler Bouncy Castle as also posted on the RealClearMarkets.com website pula pula inflavel and can be viewed here.Acheter Parc Aquatique Gonflable

Replica uhren kaufe

relojes de imitacion

panerai replicas

omega replicas

>